Donation Invoice

If you receive both cash and card payments add a line for each payment type coded to the. In addition to our partnership with Global Glimpse we support the work of many incredible nonprofits including Together We Rise.

It is an investment of trust on the part of our donors or amanah that we take.

. To receive a tax deduction the donor. Rules Around Donation Tax Receipts. You can create professional looking invoices with a template that you can customize for your business.

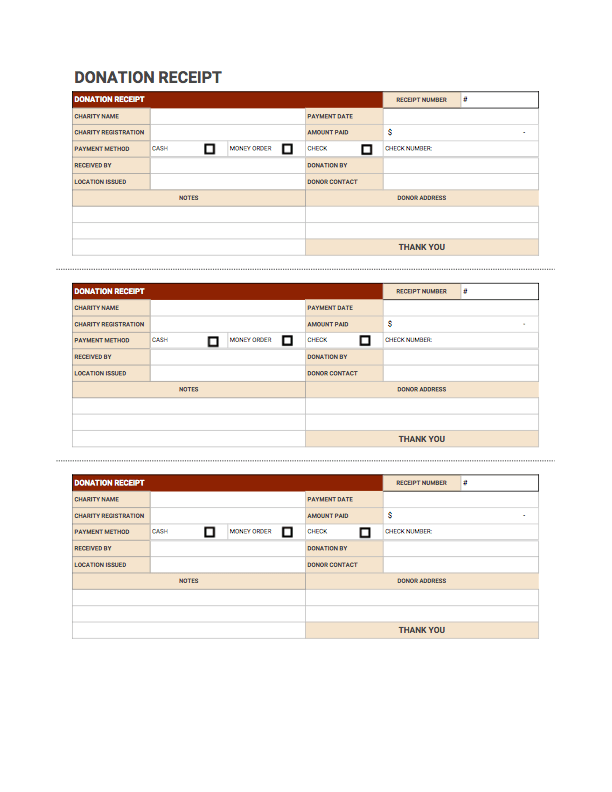

Free donation receipt templates available for Excel and Google Sheets. Invoice Central is our application designed to simplify the process of receiving and paying your American Red Cross invoices. Create donation receipts online now.

Updated June 03 2022. Moreover you can only issue a donation receipt under the name of the individual who made the donation. The name of the benefactor or donor.

Bookkeeping Let a professional handle your small business books. A donation receipt is a written acknowledgment that a donation was made to a nonprofit organization. Where your donation goes The generous support of our donors has allowed us to reach over 120 million people since 1984.

If claiming a deduction for a charitable donation without a receipt you can only include cash donations not property donations of less than 250. Send the completed invoice to your client either by email or by mail. With all the necessary fields simply download print and use.

For help determining the value of goods being donated see the Salvation Armys Donation Value Guide. Call in your donation by dialing 1-800-HELP NOW. You can pay these invoices with credit card PayPal bankcard or other supported payment types.

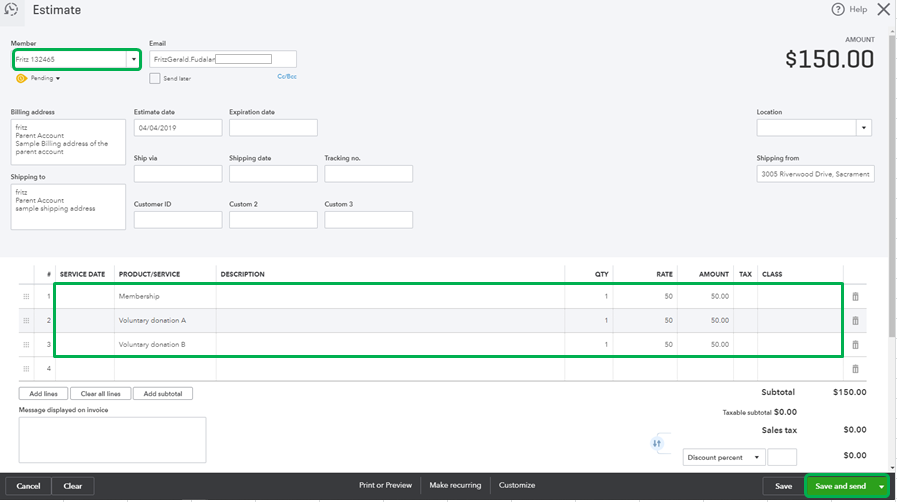

Before we dive in check out our online invoice generator for an easy way to create an invoice for your projects that will look fantastic. Add a sales invoice to record the types of payments you receive such as cash sales or credit card payments. Include a short cover note that highlights the important details like the invoice due date and the total amount owing.

When youre a small business that provides a service to customers then you need to be able to bill them for those services with an invoice. Examples of revenue recognition 24 Government Grants 187 25 Borrowing Costs 189 26 Share-based Payment 191 27 Impairment of Assets 197. If you are just starting out with a small number of products without many variants Microsoft Excel is a good tool for beginners to create an inventory list template.

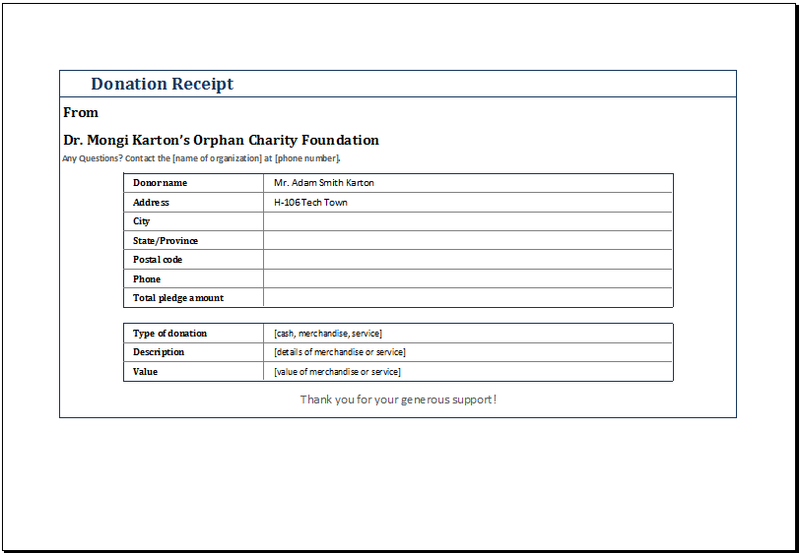

Click the add icon then select Invoice. 123 Monroe Way Apple Valley CA 92307. Sample 501c3 Donation Receipt DONATION RECEIPT.

Make a donation online by selecting DONATE FUNDS in the upper left-hand corner of the page. Together We Rise works to improve the lives of youth in the US foster care system. This category also includes intangible property such as securities copyrights and patents as well as items that can be used as fundraisers for prizes or put up for auction to raise money.

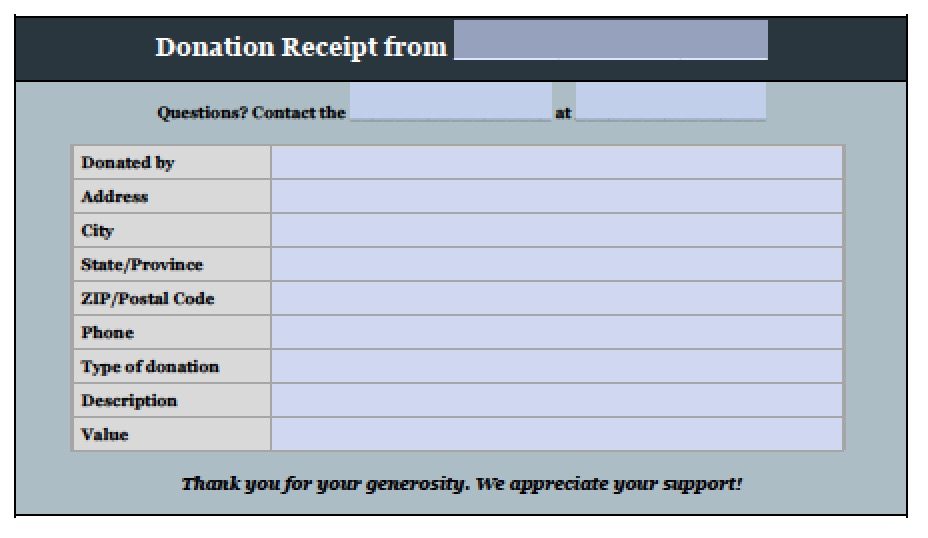

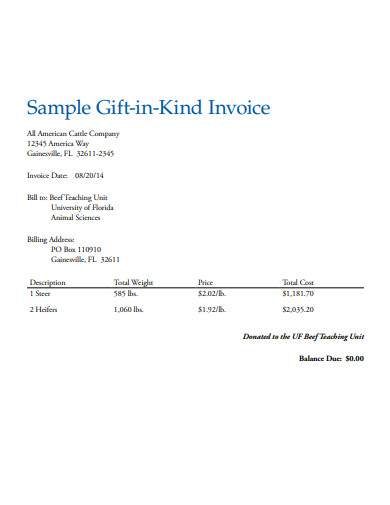

An in-kind donation receipt is used for the donation of any type of property or goods that has an undistinguished value such as clothing furniture appliances or related items. These donation receipts are written records that acknowledge a gift to an organization with a proper legal status. Fill it out in Word or Excel and send it electronically as a PDF or print it.

Examples of goods or property that might qualify as an in-kind donation are computer hardware and software office furniture medical supplies and food. Providing people with specific information is a strong way to grab their. All your outstanding donation payments and invoices can be found on your Donation Account Dashboard.

However there are certain specifications around the donation including cash limits and type of donation. The Salvation Army being a 501c3 organization accepts almost anything of value even unused airline miles. Make it easy for people to make a donation.

Enter the details of the takings. Behind that impressive statistic is millions of pounds worth of donations a massive global aid operation and a huge amount of trust. Many people are willing to make a donation to charitable organizations you just need to connect with them.

The donor has provided us with a paid invoice for that amount and her tax advisor has indicated that the University should provide her with an acknowledgement letter for this gift-in-kind viz the publishing expense. Since the dawn of time people have struggled with the right way to say thank you. Small business tax prep File yourself or with a small business certified tax professional.

Updated June 03 2022. In many cases when youth move between homes. A Salvation Army donation receipt is used to report items at cash value when determining the tax-deductible value.

Inventory management is t2e operational backbone of any business with a product to sell. How to Make an Invoice from an Excel Template Mac To make an invoice using an Excel template on a Mac computer follow these invoicing steps. 3CR broadcasters present around 125 radio programs every week with 20 community language shows in 13 different languages and 10 hours of Indigenous programming and listeners can tune in on 855AM stream live through.

While this is obvious it can be easy to forget. If you would like to pay your donation sooner you can request an invoice from your Donation Account Dashboard. Be specific in your ask.

The donor suite and the waiting room with a gas fireplace cushioned swivel chairs a coffee and tea bar flavor-enhanced water Gatorade juice granola bars snack-size bags of popcorn and pretzel chips are a far cry from the more familiar hospital-esque vibe with juice and cookies found at most mobile blood donation centersthough. A donation of just 10 helps one student see the world. If you plan to create your own template make sure to include the following information.

And you must provide a bank record or a payroll. Record separate payments on the invoices then reconcile them. With Invoice Central we have provided a way for your.

From prehistoric grunts around a campfire Urrrpgood meat all the way to present-day postings on Facebook Shout out to my peeps weve come up with lots of easy ways to say thanksPhone calls emails text messagesthey all get the job done. Goodwill Industries of Northern New England. Writing a Request for Donation Letter is a great way to aid in fundraising especially when properly written.

23 Revenue 174 Appendix. Include the link to your donation page in your ask and dont be afraid to point out exactly where the donation button is located on your fundraiser. For example a business may choose to donate computers to a school and declare that donation as a tax deduction.

Name of the Non-Profit Organization. The FMV donation of a printing company producing our Annual Report for say 15000 was right at home and comfortable. Whether youre writing a donation request letter for a charity a church or other sponsorship our sample donation letter template can help you get started.

The date when the benefactor or donor made the donation. Payroll Payroll services and support to keep you compliant. By providing receipts you let your donors know that their donation was received.

What causes does Away support. Registered nonprofit organizations can issue.

Free In Kind Personal Property Donation Receipt Template Pdf Word Eforms

Free Donation Invoice Template Receipt Pdf Word Excel

10 Non Profit Invoice Templates Pdf Psd Google Docs Word Free Premium Templates

Can I Send Invoices For Donations

9 Charity Invoice Templates In Google Docs Google Sheets Excel Word Numbers Pages Pdf Free Premium Templates

Donation Receipt Template Donation Letter Receipt Template Donation Form

Donation Receipt Free Downloadable Templates Invoice Simple

Non Profit Invoice Template Free Downloadable Templates Freshbooks